Allowable depreciation calculator

If asset is put to use for less than 180 days then amount equal to 50 of the amount calculated using normal depreciating rates is allowed as depreciation. Year Tax-allowable depreciation.

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

When you need to calculate your propertys basis eg.

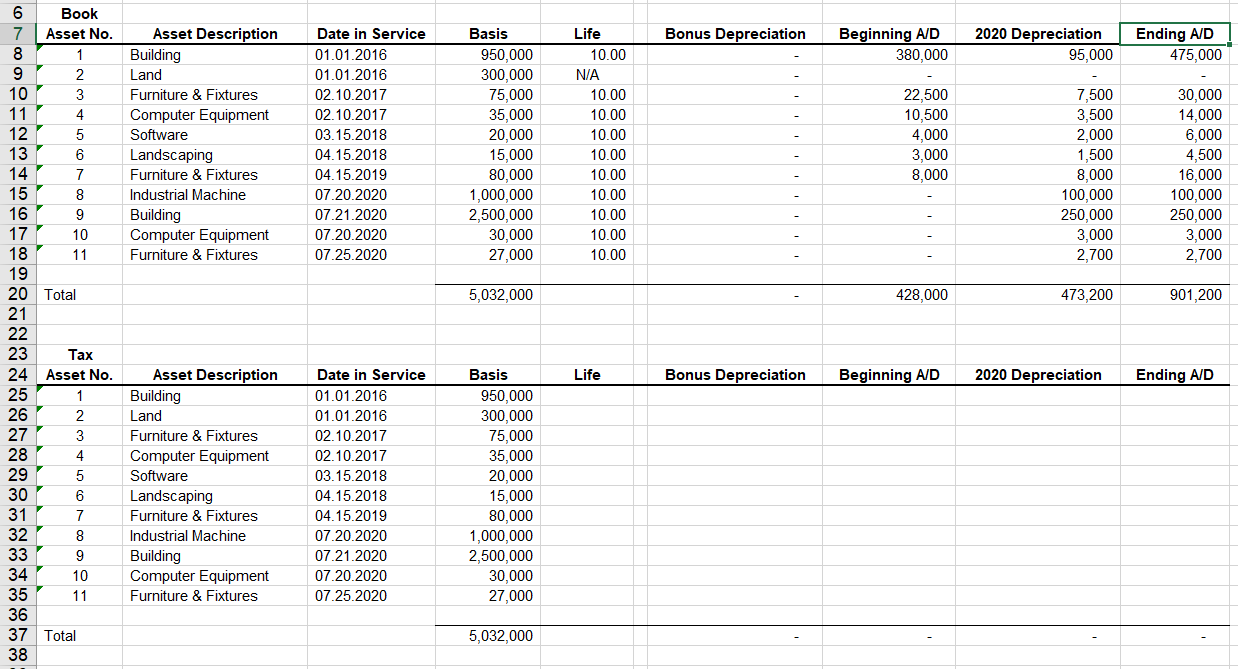

. Three factors help determine the amount of Depreciation you must deduct each year. For depreciation purposes or when you sell the asset the basis of your depreciable property must be reduced by the depreciation that. Section 179 deduction dollar limits.

Note that this figure is essentially equivalent to. The allowed rate of depreciation for furniture and fittings is 10 while plant and machinery can be. For depreciation purposes or when you sell the asset the basis of your depreciable property must be reduced by the depreciation that.

To calculate the allowable depreciation you must divide the cost of the asset by the useful life. After two years your cars value. This provides you with the yearly allowable depreciation.

The companys cost of capital is 8. Ie Asset put to use on or before. The recovery period of property is the number of years over which you recover its cost or other basis.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. Asset cost - salvage valueestimated units over assets life x actual units made. The assets are broadly categorized into furniture plant and machinery.

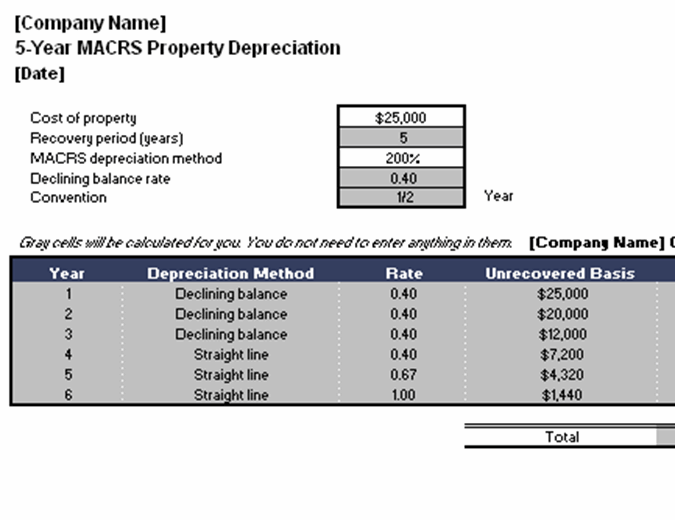

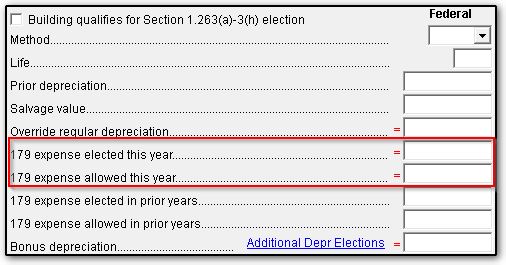

Per the IRS you are allowed an annual tax deduction for the wear and tear of property over the course of time known as Depreciation. Uses mid month convention and straight-line. The calculation is based on the Modified Accelerated Cost Recovery method as described.

This calculator will calculate the rate and expense amount for personal or real property for a given year. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562. Calculating Depreciation Using the Units of Production Method.

Percentage Declining Balance Depreciation Calculator. Then use the calculator to calculate the maximum allowable capital depreciation for that asset. How to Calculate Depreciation in real estate.

Only use as much of your capital cost allowance CCA as is reducing your. Ad Need an Easy Accurate Way to Comply with State Depreciation Across Multiple States. The tool includes updates to.

After a year your cars value decreases to 81 of the initial value. Before you use this tool. A balancing allowance is claimed in the final year of operation.

Our car depreciation calculator uses the following values source. 23125 4 40000 5000- 23125 11875. When you need to calculate your propertys basis eg.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. It is determined based on the depreciation system GDS or ADS used.

Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. For example if you have an asset. Cost of Asset Useful Life Yearly.

Therefore the percent depreciable would be 80 percent. As a real estate investor. For every year thereafter youll depreciate at a rate of 3636 or 359964 as long as the rental is in service for the entire year.

This limit is reduced by the amount by which the cost of. Your basis in your property the recovery. If you bought the property for 400000 and the land is worth 80000 the depreciable basis would be 320000.

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation And Book Value Calculations Youtube

How To Calculate Depreciation On Rental Property

Macrs Depreciation Calculator Based On Irs Publication 946

Macrs Depreciation Calculator Straight Line Double Declining

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Double Declining Balance Depreciation Calculator

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Business Costs That May Be Capitalized Eme 460 Geo Resources Evaluation And Investment Analysis

Macrs Depreciation Calculator Irs Publication 946

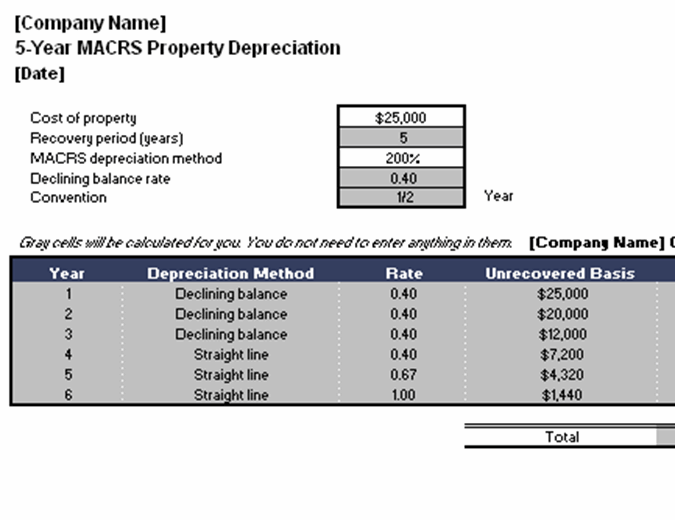

On The Tab Marked Depreciation Schedule Complete Chegg Com

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

4562 Section 179 Data Entry

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Capital Investment Appraisal Tax Allowable Depreciation Acca F9 Youtube